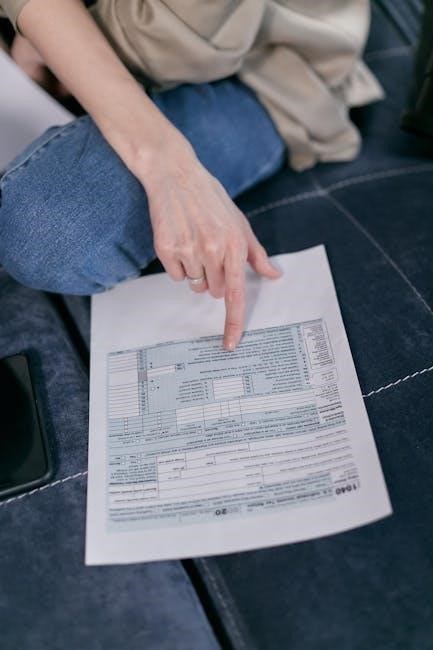

IRS Form 1120-W is used by corporations to estimate their tax liability and make quarterly payments. It ensures accurate calculations and timely payments to avoid penalties.

Overview of Form 1120-W

IRS Form 1120-W is used by corporations to estimate their annual tax liability and determine the amount of quarterly installment payments. It is specifically designed for C corporations that anticipate owing $500 or more in taxes. The form includes Part I for calculating estimated tax and Part II for tracking payments made throughout the year. It ensures compliance with IRS requirements for timely and accurate payments.

Importance of Accurate Filing

Accurate filing of Form 1120-W is crucial to avoid penalties and ensure compliance with IRS regulations. It helps corporations estimate taxes correctly, avoid underpayment penalties, and maintain proper financial records. Timely and precise payments prevent additional interest and fees, ensuring smooth cash flow management and maintaining good standing with tax authorities.

Who Needs to File Form 1120-W

C corporations owing $500 or more in income tax must file Form 1120-W to estimate taxes and make quarterly payments, ensuring compliance with IRS requirements.

Corporate Eligibility Criteria

Form 1120-W is required for C corporations anticipating a tax liability of $500 or more annually. These corporations must file to estimate taxes and make quarterly payments, ensuring compliance with IRS rules to avoid penalties. Eligibility is based on expected income and tax owed, with smaller corporations below the threshold exempt from filing. This ensures timely payments throughout the tax year.

Threshold for Filing Requirements

Corporations must file Form 1120-W if their estimated tax liability exceeds $500 annually. This threshold determines whether quarterly payments are required. Corporations with tax liabilities below this amount are exempt, simplifying their filing obligations. The $500 threshold ensures smaller corporations are not burdened with quarterly payments, while larger entities maintain compliance through timely estimated tax submissions.

Key Components of Form 1120-W

Form 1120-W consists of two main parts: Part I for calculating estimated tax liability and Part II for documenting quarterly payments, ensuring accurate compliance with IRS requirements.

Part I: Estimated Tax Calculation

Part I of Form 1120-W requires corporations to estimate their annual tax liability. It involves calculating projected income, deductions, and credits. Corporations must use either the annualized income method or the safe harbor rule, ensuring payments align with IRS requirements. Accuracy is critical to avoid penalties, as underpayments may result in additional charges. This section helps businesses plan and manage their quarterly payments effectively throughout the tax year.

Part II: Record of Estimated Tax Payments

Part II of IRS Form 1120-W is used to document all estimated tax payments made by the corporation during the tax year. It requires listing each payment, including the amount paid and the date of payment. This section ensures transparency and accuracy in tracking payments, helping to verify compliance with quarterly payment obligations. It also aids in reconciling payments with the total tax liability reported on the corporation’s annual return.

Calculating Estimated Tax Liability

Calculating estimated tax liability involves determining a corporation’s expected tax for the year. It requires accurate income projections and applying the correct tax rates to ensure compliance with IRS requirements.

Methods for Estimating Income

Corporations use methods like the annualized income method or the safe harbor rule to estimate income. The annualized method bases estimates on income periods, while the safe harbor rule ensures payments equal 100% of prior year’s tax or 110% for large corporations, avoiding underpayment penalties. Accurate projections help in making timely and correct quarterly payments, ensuring compliance with IRS regulations.

Applying Tax Rates and Credits

Corporations apply federal tax rates to their estimated income, considering progressive tax brackets. Credits, such as research or foreign tax credits, are subtracted from the total liability. The form requires precise calculation of applicable credits and rates to ensure accuracy. Proper application helps avoid penalties and ensures compliance with tax obligations, reflecting the corporation’s true tax liability for the year.

Important Due Dates

IRS Form 1120-W requires corporations to make quarterly estimated tax payments by April 15, June 15, September 15, and December 15 of each tax year.

Quarterly Payment Deadlines

Corporations must make estimated tax payments by April 15, June 15, September 15, and December 15 of each tax year. These deadlines ensure timely payments and avoid penalties. Missing a deadline may result in underpayment penalties and interest, even if the total tax is paid by the annual return due date. Accurate tracking of these dates is essential for compliance with IRS requirements.

Consequences of Missing Deadlines

Missing quarterly payment deadlines for IRS Form 1120-W can result in penalties and interest on the unpaid amount. The IRS charges a penalty, typically a percentage of the unpaid tax, plus interest accruing from the original due date until payment is made. These penalties apply even if the total tax liability is paid by the annual return deadline, emphasizing the importance of timely payments.

Payment Methods

IRS Form 1120-W payments can be made using the Electronic Federal Tax Payment System (EFTPS) or alternative methods like checks or money orders, as specified.

Electronic Federal Tax Payment System (EFTPS)

The Electronic Federal Tax Payment System (EFTPS) is a secure online platform for making IRS estimated tax payments. Corporations can use it to submit quarterly payments for Form 1120-W. Payments can be scheduled in advance, and the system provides instant confirmation. EFTPS is available 24/7, making it a convenient option for businesses to meet their tax obligations. Enrollment is required, but it simplifies the payment process and helps ensure timely payments to avoid penalties.

Alternative Payment Options

For corporations unable to use EFTPS, alternative payment options include check or money order payments. Ensure the payment is accompanied by the correct Form 1120-W voucher to avoid processing delays. Payments must be postmarked by the quarterly due date to prevent penalties. Use a secure mailing method to ensure timely delivery to the IRS address listed in the instructions. Always retain a copy of the payment and voucher for records.

Penalties for Underpayment

Penalties apply for underpayment of estimated taxes, calculated on the unpaid amount for each quarter. The IRS applies penalties quarterly, ensuring timely payments are essential.

Calculating Penalty Amounts

The penalty for underpayment is based on the unpaid amount for each quarter. The IRS calculates it using interest rates set quarterly. Interest accrues from the original due date of each payment. Higher underpayments result in higher penalties. Accurate estimated tax payments are crucial to avoid these penalties and ensure compliance with IRS requirements.

Waiver of Penalties

The IRS may waive penalties for underpayment if reasonable cause is established. Taxpayers can request a waiver by filing Form 2210 and providing documentation. Common reasons for waiver include first-time penalty abatement or administrative errors. Penalties may also be waived if the underpayment is due to unforeseen circumstances. Proper documentation and timely filing are essential to support the waiver request and avoid further IRS scrutiny.

Filing for an Extension

Corporations can file Form 7004 to request an automatic six-month extension for submitting IRS Form 1120. This avoids late filing penalties if timely submitted with estimated taxes paid.

Form 7004: Automatic Extension

Form 7004 allows corporations to request an automatic six-month extension for filing IRS Form 1120. It must be filed by the original deadline and requires an estimate of tax liability. This form provides additional time for filing but does not extend the deadline for paying taxes. Corporations must pay estimated taxes to avoid penalties and interest during the extension period.

Implications of Filing an Extension

Filing Form 7004 grants corporations an automatic six-month extension to file IRS Form 1120. However, it does not extend the deadline for paying taxes. Corporations must still submit estimated taxes to avoid penalties and interest. The extension provides additional time for filing but requires accurate estimation of tax liability. Failure to pay timely may result in penalties and interest, even with an extension.

Amended Returns

Amended returns allow corporations to correct errors or update estimates on previously filed IRS Form 1120-W. This ensures accuracy and compliance with tax obligations.

Correcting Previously Filed Estimates

Corporations can amend their IRS Form 1120-W to correct errors or update estimates. This involves recalculating tax liability, adjusting quarterly payments, and ensuring compliance with IRS requirements. If discrepancies are found, filing an amended form helps avoid penalties and ensures accurate tax reporting. Corporations should review prior estimates, make necessary adjustments, and submit the corrected form promptly to maintain compliance and avoid additional charges.

Procedure for Filing Amendments

To file an amendment for IRS Form 1120-W, corporations must submit a corrected form with updated estimates. This involves recalculating tax liability and adjusting payments. Amendments should be filed electronically or by mail, ensuring accuracy and compliance with IRS guidelines. Proper documentation and timely submission are crucial to avoid penalties and maintain compliance with federal tax requirements.

Record-Keeping Best Practices

Maintain accurate and detailed records of estimated tax payments and calculations. Organize documentation, including payment receipts and filed forms, for compliance and audit preparedness.

Documentation Requirements

Corporations must maintain detailed records of estimated tax payments, including payment receipts, calculation worksheets, and filed Forms 1120-W. Ensure all documents are up-to-date, accurate, and accessible for IRS review. Keep records of business address changes and supporting documentation for tax liability estimates. Organize files securely to facilitate compliance checks and audits, ensuring transparency and accountability in corporate tax obligations.

Organizing Payment Records

Keep a centralized digital or physical file of all estimated tax payments, including payment confirmation receipts and bank statements. Use spreadsheets or accounting software to track quarterly payments and ensure they align with Form 1120-W submissions. Maintain a clear record of payment dates, amounts, and methods to ensure transparency and compliance with IRS requirements.

State-Specific Considerations

States may have additional estimated tax requirements for corporations. Ensure compliance with both federal and state obligations to avoid penalties.

State Estimated Tax Requirements

State estimated tax requirements vary by jurisdiction, often mirroring federal guidelines but with specific rules. Corporations must check each state’s regulations where they operate to ensure compliance. Some states require quarterly payments similar to IRS Form 1120-W, while others have different thresholds or due dates. Coordinating federal and state filings is crucial to avoid penalties and ensure accurate tax payments.

Coordinating Federal and State Filings

Coordinating federal and state filings ensures compliance with both jurisdictions. Corporations must align their estimated tax payments with state-specific requirements, which may differ from federal deadlines. Tracking state deadlines and payment thresholds is essential to avoid penalties. Consulting state tax authorities and maintaining accurate records helps streamline the process and ensure timely submissions for both federal and state obligations.

Understanding IRS Form 1120-W is crucial for corporate tax compliance. Staying informed about requirements and best practices ensures accurate filings and avoids penalties, maintaining financial integrity.

IRS Form 1120-W is essential for corporations to estimate tax liability and make quarterly payments. It ensures compliance with IRS requirements, avoiding penalties. Accurate calculations and timely submissions are crucial. Corporations must meet specific eligibility criteria and adhere to filing thresholds; Proper documentation and understanding of the form’s components are vital for maintaining compliance and avoiding financial penalties.

Final Tips for Compliance

To ensure compliance, corporations should make timely quarterly payments and accurately calculate estimated tax liability using Form 1120-W. Utilize the EFTPS for secure payments and maintain detailed records of payments and calculations. Regularly review IRS guidelines and consult tax professionals if needed. This helps avoid penalties and ensures smooth filing processes, maintaining good standing with the IRS.

Leave a Reply

You must be logged in to post a comment.